Coygo offers automated trading tools where traders can set up arbitrage bots to find latency between exchanges within a millisecond or less. It is compatible with various exchanges and feeds trade into each platform via real-time WebSockets. Investors can access pre-built and configurable strategies for their bots or code fully customized techniques with Javascript. A free plan is available for users to understand and test the system. Let’s review various aspects to determine its efficiency or whether it deserves your investments in 2022?

Coygo detailed analysis

Coygo provides services in 75+ countries and is trusted by over 5000 traders, as claimed by the vendor. It offers several preset or customizable filters to give you an idea about the best assets to buy. You can transfer assets between exchanges and analyze trade history.

How Coygo works

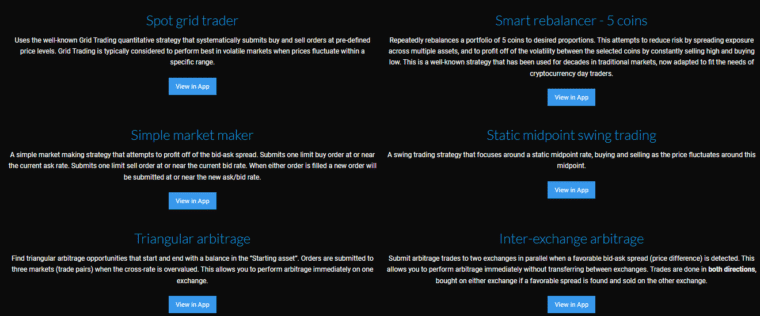

Coygo works on Windows, Mac, or Linux and is also accessible from the mobile phone. Several trading strategies are configurable according to your liking, such as Grid, Swing, market-making, etc. The most popular trading approach is triangular arbitrage, which exploits the price differences between three assets. For example, with your BTC, buy ETH, and with that purchase, LTC and convert LTC back to Bitcoin.

Registration process

Traders can register and start trading with Coygo in the following steps:

- Sign up on the website with your name and email

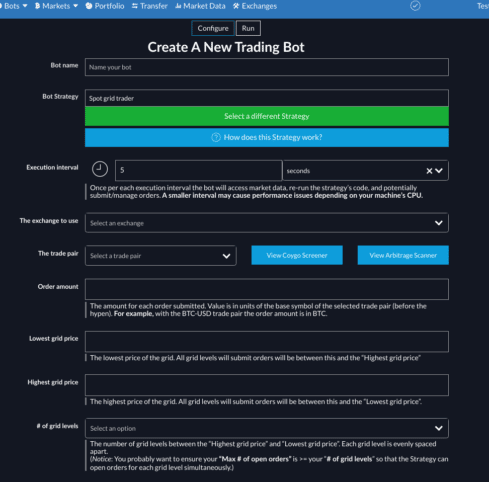

- Create a new bot and name it

- Choose a trading strategy that best suits your needs

- Select the cryptocurrency exchange.

- Choose a trading pair and funds to be invested

- Set highest/lowest grid price and the number of grid levels

- Run the bot in test mode to check its functioning without using real funds

- The system is ready to start trading

Is it easy to use?

Coygo provides extensive tutorials and blogs about using bots and their features. Traders with no coding skills can use from a list of pre-built strategies and tweak the settings as they like. Writing a code for customized trading requires the knowledge of JavaScript.

Coygo key highlights

The key features of trading with Coygo are:

- Investors can submit and manage orders on multiple exchanges at the same time.

- The bot supports various systems like Windows, Mac, and Linux.

- Test your strategies in a test mode with demo funds.

- It supports inter and intra-exchange arbitrage with low risk.

- The trading strategies are configurable to meet your needs.

Services offered by Coygo

The following are some of the most important services of this trading bot:

- Multi exchange crypto trading

- Unified API

- Transfer between exchanges is quick

- Portfolio management

- Trading with a single click

- Smart order routing

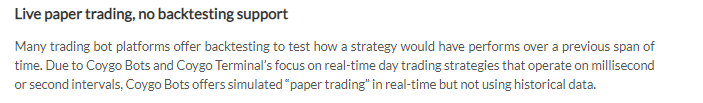

Backtesting

Coygo does not offer backtesting for its users, which is an essential tool to under the bot’s performance on historical data. There are no live records on its website, and it lacks customer reviews on trusted websites.

Does it have a native token?

Coygo does not have a native or governance token. It is a trading bot and not an exchange.

Coygo user interface

The user interface is not simple and easy. It can be complex for new traders as the website contains lots of scattered information about the bot, making it confusing. It is only available in English.

Is it a good bet for its price?

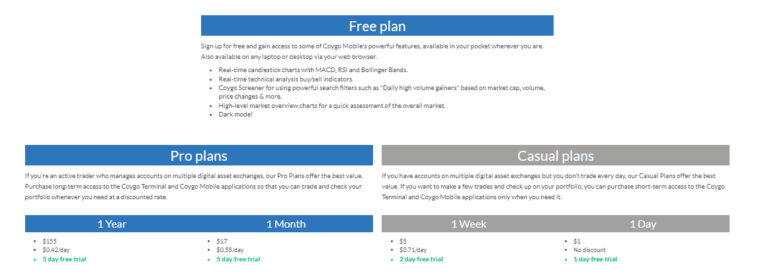

Coygo has relatively affordable and low-cost pricing plans compared to other similar platforms. The subscriptions depend on the nature of traders, e.g., the pro plan costs $17/month and $155/year, whereas casual comes for $1/day and $5/week. It also offers a free plan and customized packages.

What exchanges does it support?

Coygo works with the following crypto exchanges:

- Binance

- Coinbase

- Binance US

- Coinbase Pro

- Kraken

- Kucoin

- Bittrex

- Bitstamp

- Bitflyer

- Poloniex

- Gemini

- Bitfinex

Coygo trading assets

At Coygo, you can trade several assets depending on the exchange. Some major coins include BTC, ETH, XRP, LTC, ADA, TRX, BNB, etc.

Are there any fees?

Coygo provides no information on its trading or transaction fees.

Withdrawal process

Coygo recommends not to enable withdrawal permission because of the risk of losing funds. The withdrawal process of funds from Coygo is unknown.

Coygo: is it legit?

Coygo lacks essential features like backtesting that allows traders to test their strategies on historical records. It lacks customer feedback on a reputable website like TrustPilot, raising doubts about its legitimacy. It is not featured by any authentic and major website or blogs.

What kind of security does Coygo offer?

Coygo does not have access to the information of the investors. This implies that only the user may see their account and no one else. Only the trader has an approach to their data, APIs, and funds.

Is Coygo regulated?

Coygo does not provide information about the regulation of its software.

Best recommended for: casual traders

Coygo best suits casual traders who do not trade for a long time or continuously. They can benefit from extremely low-cost weekly or one-day subscription plans.

Coygo customer support

Traders can reach the customer support team in the following ways:

- Live chat (only available when staff is present in the office)

- Email support

- FAQs

How does Coygo’s reputation look?

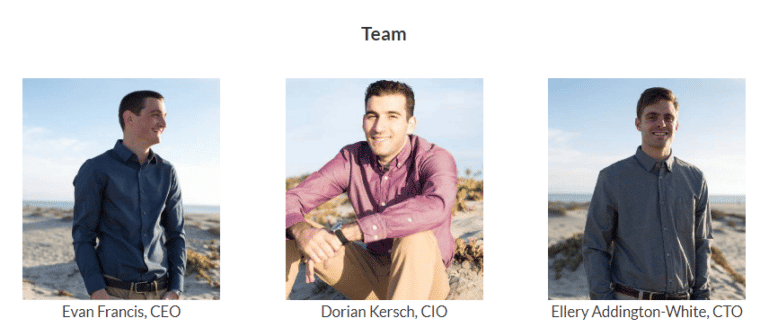

Coygo is a San Diego, California, US-based company and the board members include Evan Francis, CEO, Dorian Kersch, CIO, and Ellery Addington-White, CTO.

Coygo Crypto Bot

Coygo-

Features3/5 Neutral

-

Supported Exchanges2/5 Bad

-

Price3/5 Neutral

-

Security2/5 Bad

-

Customer Support3/5 Neutral

The Good

- Submit orders on multiple exchanges

- It includes daily and weekly plans for daily traders

The Bad

- There is no backtesting or live records

- It does not support margin trading

- Coygo trades only on shorter intervals (5mins or less)