Rombus Capital is a service that promises to grow the wealth of Forex traders and investors even if they are not seasoned professionals. According to the vendor, it provides deep market insight and allows traders to make use of lucrative investment opportunities.

Rombus Capital has verified live trading results but demands a high monthly fee for its services. It seems to be following a high-risk strategy that leads to a high drawdown. As such, our first impression of the system is not too positive.

What Is Rombus Capital?

Rombus Capital employs asset managers who provide managed account services to traders. As per vendor claims, it has a great track record, but this is not entirely true. Currently, it has ties with brokerage firms like TradeView, IG Bank, and Hogg Capital. However, you can use any broker of your liking.

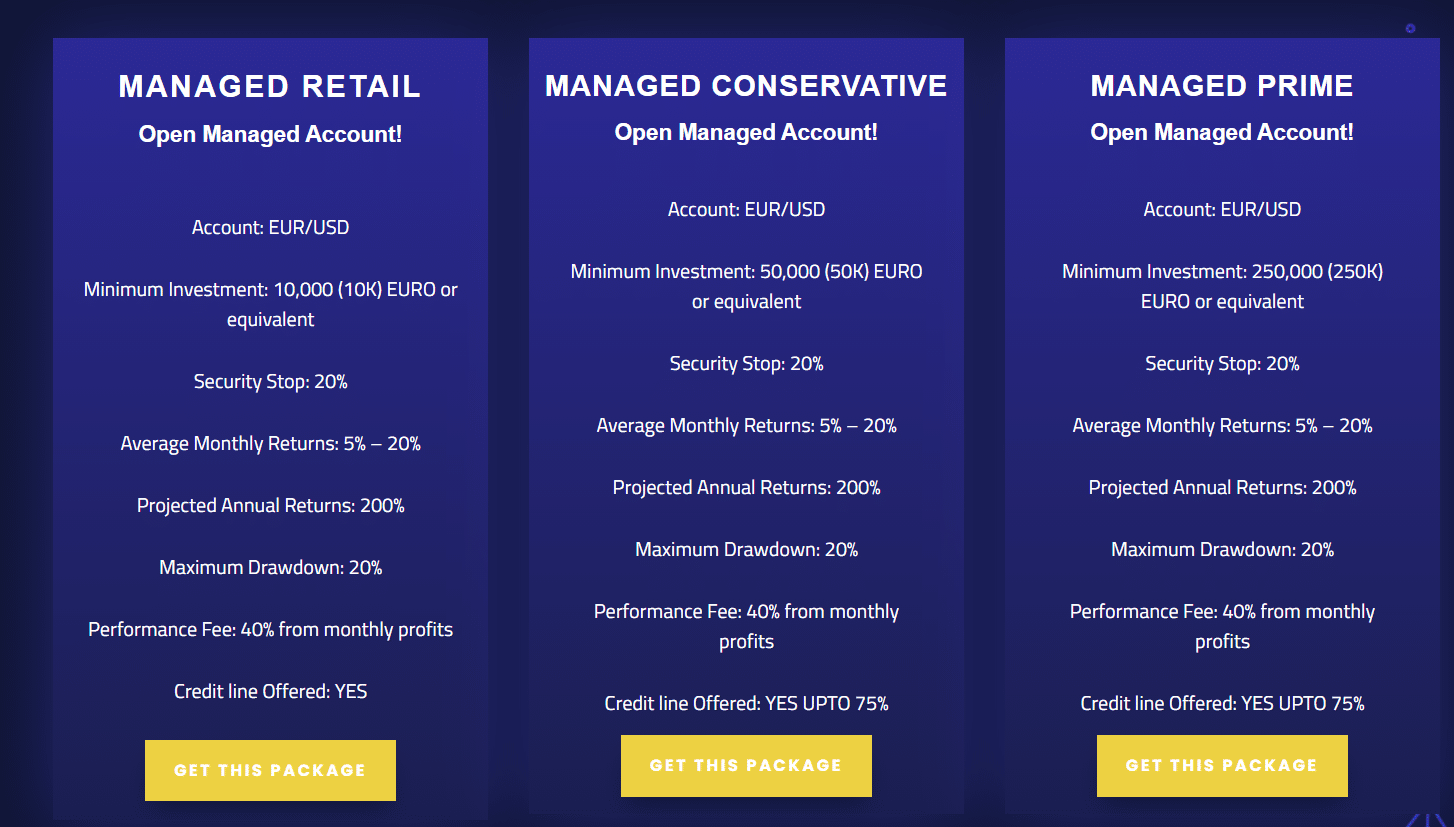

For the retail plan, the minimum deposit is 10k Euros, while the conservative and prime plans have minimum investments of 50k Euros and 250k Euros, respectively. The vendor does not mention how much leverage is required, but for the live trading account, Rombus Capital uses 1:200 leverage.

Official Rombus Capital Website

On the official website, the vendor provides us with a short introduction to the system, followed by some information about the company’s vision. There are links to multiple investment accounts as well as a live trading account. Finally, there is a contact form that you can use to reach out to the service team. The website also has an FAQ section, as well as one for the various investment packages.

We don’t have any information on the parent company, so we don’t know when it was founded or whether it has a successful track record. The vendor has not revealed the identities of any of the team members, however, we know that the headquarters is located in Kowloon, Hong Kong. Hence, we are disappointed by the lack of vendor transparency and our expectations from this service are pretty low.

How Can We Use Rombus Capital?

After you sign up for this service, you will need to choose an investment package. Based on those plans, you will receive signals from traders and have your account handled by money managers. The company provides 24/7 customer support for all traders.

Pricing & Refund

These are three pricing plans available for Rombus Capital. They are all EUR/USD accounts with a security stop of 20% and promising average monthly returns of 5-20%. These plans have different minimum investment amounts but the performance fee is the same for all. You need to pay 40% of your monthly profits, which we feel is a bit too much. Moreover, the vendor does not offer a refund.

Trading Strategy

We don’t know what kinds of strategies are followed by the traders for generating the trading signal. The vendor has not provided any strategy-related information on the official website, which is quite disappointing. Since this is not an automated trading system, we don’t have the backtesting results for Rombus Capital.

Current Performance

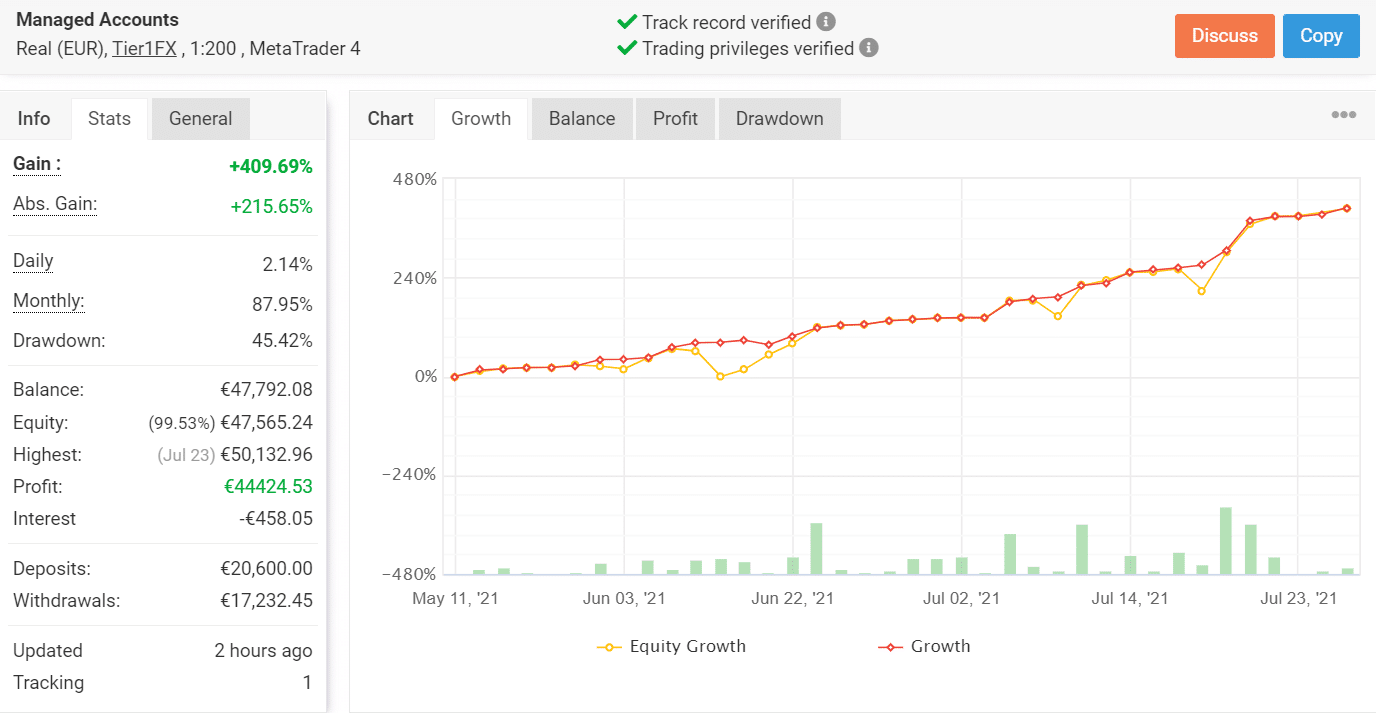

This live trading account on Myfxbook was launched on May 11, 2021, so it doesn’t really have a long track record. The EA has placed 299 trades through this account, winning 213 out of them, and this means it has a win rate of 71%. Rombus Capital has generated a total profit of 44424.53 Euros through this account, and the profit factor is 3.53.

Currently, the daily and monthly profits are 2.14% and 87.95% respectively, while the drawdown is incredibly high at 45.42%. Such a high drawdown indicates that the EA uses a high-risk strategy. Following such a strategy can lead to large losses. Seasoned traders usually prefer systems where the drawdown is less than 20%.

What Customers Say

There are no user reviews for Rombus Capital on the Trustpilot website. On the Forex Peace Army website, only one user has written a review on this service provider. Thus, it is evident that it does not have a stellar reputation in the industry.

Summary: Is Rombus Capital a Trustworthy Managed Account Service?

Rombus Capital-

Strategy2/5 Bad

-

Features2/5 Bad

-

Trading Results2/5 Bad

-

Reliability1/5 Awfully

-

Pricing1/5 Awfully

Like

- Verified live trading results

Dislike

- High drawdown

- High monthly performance fee

- Money-back guarantee not available