Wall Street Forex Robot 2.0 follows a simple core trading methodology that the company has updated. The algorithm goes through multiple factors, such as calculating slippage and spreads before opening a new trade. The developers provide performance statistics through multiple accounts at Myfxbook. We have gone through each detail of the system to check if we can make any money while using it.

What is Wall Street Forex Robot?

Wall Street Forex Robot has the following features:

- It has a built-in spread filter.

- The robot comes with multiple live account results.

- Traders can enable mobile notifications and use the broker protection system.

- There is an advanced money management system built within.

- There is no recommendation on the leverage traders should have to use the EA.

- The least amount of capital is $100.

Official Wall Street Forex Robot website

The EA is presented through multiple pages on the website. Traders can access the blog and read the FAQ section. The information is scattered all over the place, so it may take some time to get the knowledge you need.

How can we use Wall Street Forex Robot?

Traders have to copy the robot in the experts’ folder of the MT 4 platform. After that, it is important to enable the auto trading option and place the robot on charts to start trading.

Pricing & refund

The robot is available for $267 a month for one live and an unlimited number of demo accounts. Traders have a 60-day money-back guarantee with the program.

Trading strategy

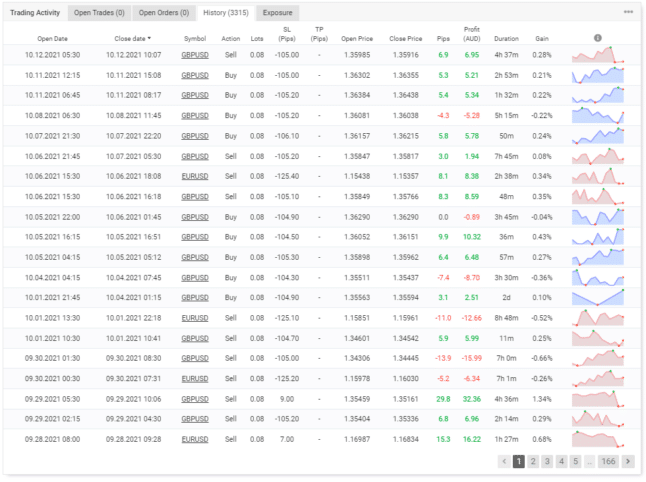

The robot works on EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, NZDUSD, and AUDUSD. It uses short-term scalping following long and short-term trends. The developer is not keen on sharing more information on the game plan, so we used the records on Myfxbook. From there, we can see that the EA day trades the markets with an average holding duration of 4 hours and 53 minutes. It uses a fixed stop loss of 100 pips or so but closes the trade before it reaches the designated exit point.

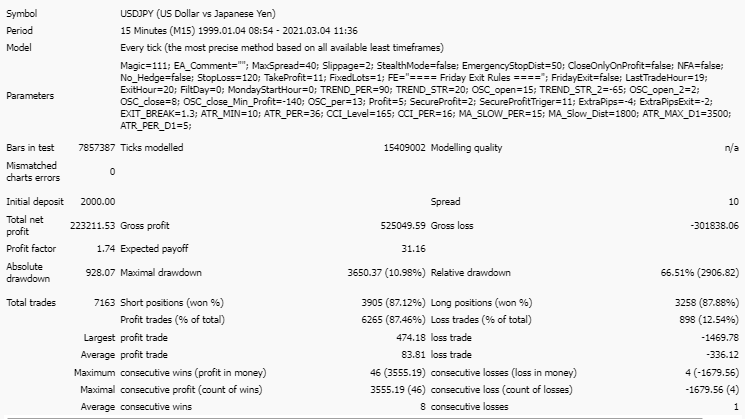

Backtesting results are available for multiple currencies. On USDJPY, the relative drawdown was around 66.51%. The winning rate was 87.46%, with a profit factor of about 1.74. All the tests were done on the 15 minutes chart with a starting balance of $2000. The robot tanked an average profit of $83.81 during this period.

There were 7163 trades in total, where the best trade was $474.18, while the worst one was -$1469.78.

Current performance

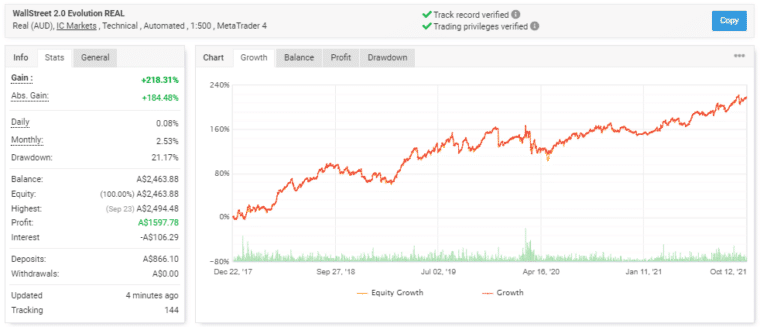

Live trading results are available on Myfxbook, which show performance from December 22, 2017, till the current date. The robot had an average monthly gain of 2.53%. There were 3313 trades in total, with 147.81 lots traded. The expert advisor traded with a winning rate of 79% and a profit factor of 1.15. The average winning trade was $4.73, while the worst one was -$15.30.

What are the real customers saying about Wall Street Forex Robot?

Unfortunately, there are no customer reviews available on Forex Peace Army that can tell us the view of other traders about the robot. Traders might be afraid of the high drawdown to a monthly ratio.

Summary: is Wall Street Forex a trustworthy robot?

Wall Street Forex-

Strategy2/5 Bad

-

Features3/5 Neutral

-

Trading results3/5 Neutral

-

Reliability3/5 Neutral

-

Pricing4/5 Good

Like

- Live records available on Myfxbook

Dislike

- It does not explain the trading strategy properly

- There is no transparency on developers