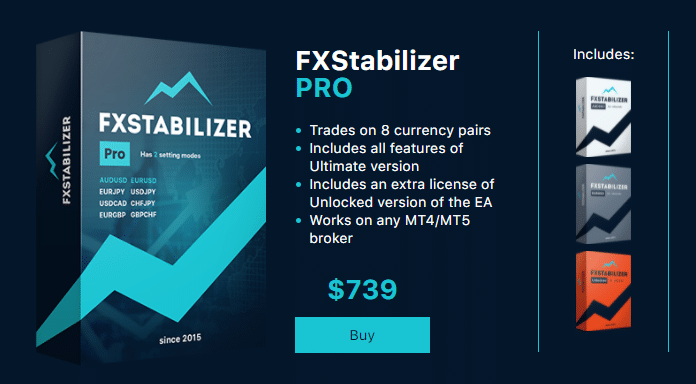

FxStabilizer comes with a hefty price tag of $739 and multiple live and backtesting records. The producer states that traders do not need any market experience to make the algorithm function properly. With so many claims about the outcome on the website, we were intrigued to get inside the features and review the product.

What is FxStabilizer?

FxStabilizer has the following features:

- Traders can enable two different modes within the system.

- It works on the MT 4 and MT 5 platforms.

- There are multiple backtesting and live records available.

- The robot can be used on up to 8 currency pairs.

There is no recommendation available on the leverage and the minimum balance required by the same to work properly

Official FxStabilizer website

The robot Is available on the company’s website through a single webpage. There are five headings present on the top that lead nowhere. They help navigate through the page only. The developers are mostly keen on sharing the records and are not transparent in other factors such as strategy.

How can we use FxStabilizer?

You can use the robot by placing it on the respective charts after the purchase. Traders will have to send their account numbers to the developers so they can activate the key.

Pricing & refund

The robot is available for $539 and $739 for ultimate and pro versions. The difference between the two is the number of currency pairs and licenses. There is a 30-day money-back guarantee with the program.

Trading strategy

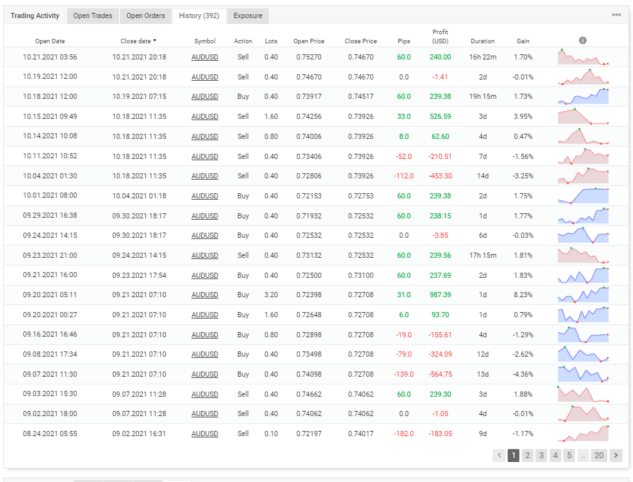

The developer only shares that the EA works on multiple currency pairs and has two modes, i.e., durable and turbo. From history, at Myfxbook, we can see that it uses grid and martingale strategies to trade the markets. Depending on the situation, the average trade duration can increase or decrease from one day to a week.

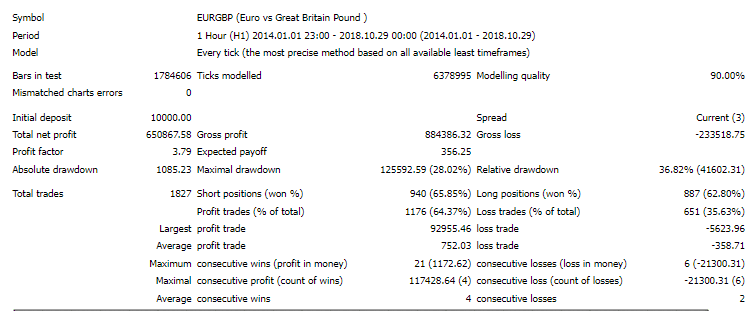

Backtesting results are available for multiple currencies, and the duration of testing varies from 7 to 10 years. For EURGBP, the relative drawdown was around 36.82%. The winning rate was 65.85%, with a profit factor of about 3.79. All the tests were done on the 60 minutes chart with a starting balance of $10000.

The robot tanked an average profit of $650867.58 during this period. There were 1827 trades in total where the best trade was $92955.46, while the worst one was -$5623.96.

Current performance

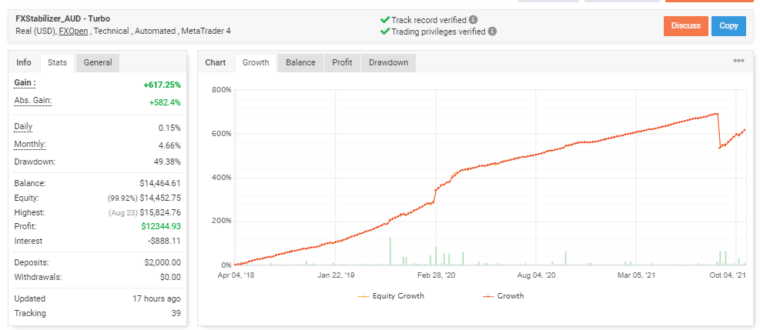

Live trading results are available on Myfxbook, which show performance from April 04, 2018, till the current date for AUDUSD turbo. The robot had an average monthly gain of 4.66%, with a drawdown of 49.38%. The high value of drawdown indicates a 50% loss of equity while trading. There were 391 trades in total, with 129.75 lots traded. The expert advisor traded with a winning rate of 59% with a profit factor of 1.69. The average winning trade was $130.33, while the worst one was -$112.52.

What are the real customers saying about FxStabilizer?

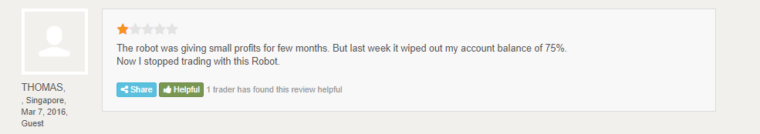

Customer reviews at Forex Peace Army show a rating of 3.353 for a total of 7 reviews. A trader says that the system gives out small profits and can result in high losses.

Summary: is FxStabilizer a trustworthy robot?

FxStabilizer-

Strategy2/5 Bad

-

Features3/5 Neutral

-

Trading results3/5 Neutral

-

Reliability3/5 Neutral

-

Pricing4/5 Good

Like

- Live records available on Myfxbook

Dislike

- Uses grid and martingale combo

- It does not explain the trading strategy properly

- There is no transparency on developers