Stenvall Mark III is a trading solution that was published on the MQL5 community at the end of June 2021. Since then, the system has received several updates to the 2.0 version on August 01, 2021. It was downloaded for demo purposes 795 times.

What is Stenvall Mark III?

Stenvall Mark III is an advisor that has been working on a real account for several years. So, people started asking us to write a review about them.

Official Stenvall Mark III website

On mql5 we have a Stenvall Mark III presentation that looks semi-professional. It includes much wording and doesn’t provide proper information about settings and details.

How can we use Stenvall Mark III?

Let’s talk about a list of features, settings, and other useful information that help us to form a vision of how it works.

- The developers run several accounts from which we can get paid signals.

- The system knows how to trade automatically.

- The robot works with low risks to the account balance.

- The main cross pair is EURUSD.

- It trades well on a short time frame – M5.

- “This is the 3rd generation of the EA Stenvall. The EA Stenvall MK III trading method is a hybrid of a trend strategy with a counter trend strategy.”

- The system fits the best those who want to trade long term periods.

- The system was released first in 2016.

- The system worked with 8% drawdowns.

- The developer claimed that “EA Stenvall MK-I MT4 was used as one of the EAs of a private hedge fund, with a total deposit of more than 2.7M USD (I can’t prove this information).”

- The system runs the account stable.

- It doesn’t use risky strategies like rollovers after Midnight, Grid, or Martingale.

- It’s not sensitive to spreads and requots.

- It covers open positions with SL levels.

- There are 76 functions on the board.

- The average TP is 150 pips.

- The installation process takes 3 minutes.

- We have to download the ready-made set file with the risk selection.

- Lot size can be from 0.01 to 0.04 for every $100.

Pricing & refund

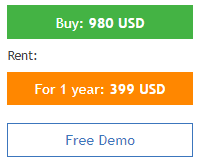

The system is available for $980 for a lifetime copy. It’s quite a high pricing that should be proved by great trading results. The one-year subscription can be bought for $399. We can download the system for demo usage.

Trading strategy

- The robot works with Trend and Counter Trend strategies.

- It works with EURUSD on the M5 time frame.

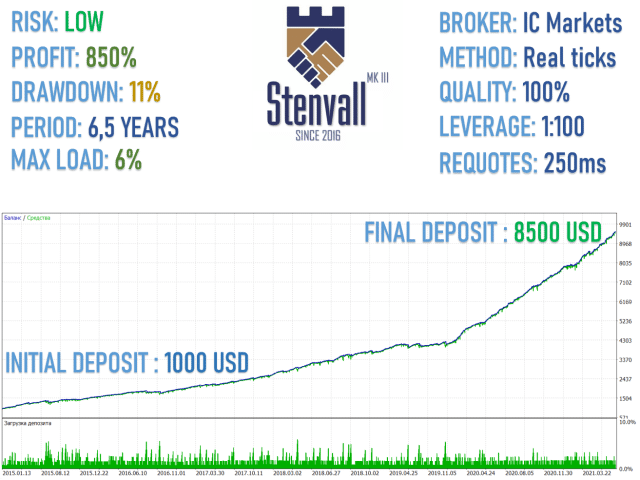

The robot was tested with low risks on IC Markets’ real tick data. The modeling quality was 100%. The leverage was only 1:100. An initial deposit was $1,000. It has become $8,500 of the final deposit for 6,5 years. The maximum drawdown was 11%. Frankly, we cannot trust this data as it cannot be verified. The screenshots the dev provides could easily be manipulated.

Trading results

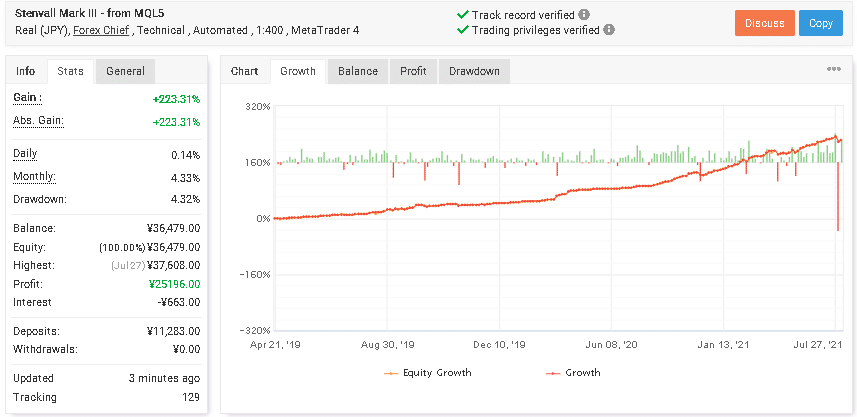

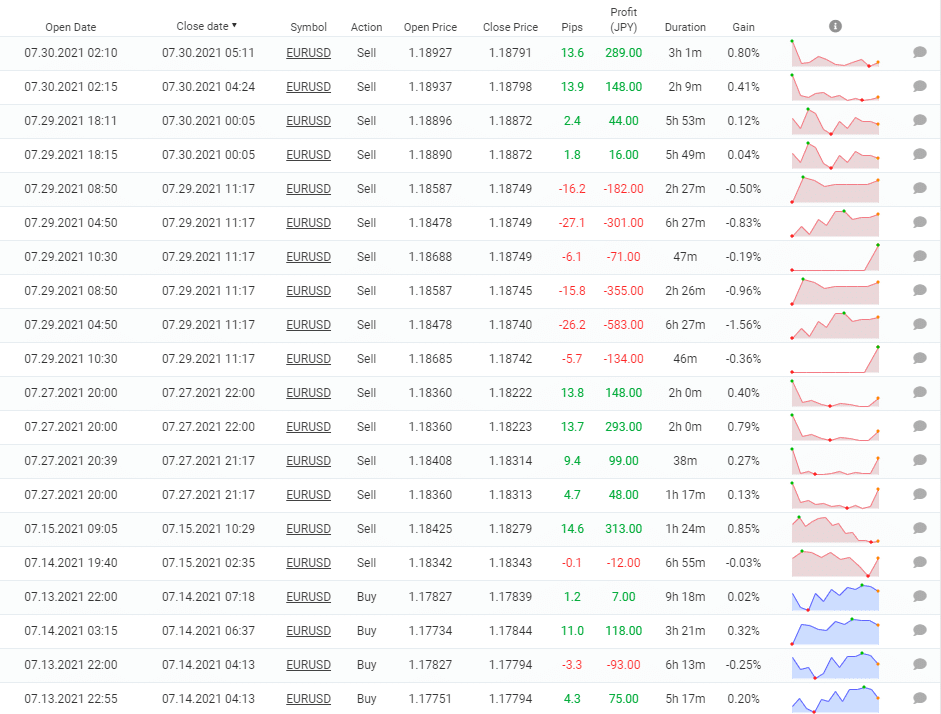

Stenvall Mark III has been working on a real JPY account with 1:400 leverage. The platform is MT4. The account has a verified track record. It was created on April 21, 2019. The absolute gain has become 223.31%. An average monthly gain is 4.33%. The maximum drawdown is 4.32%. The account is tracked by 129 traders.

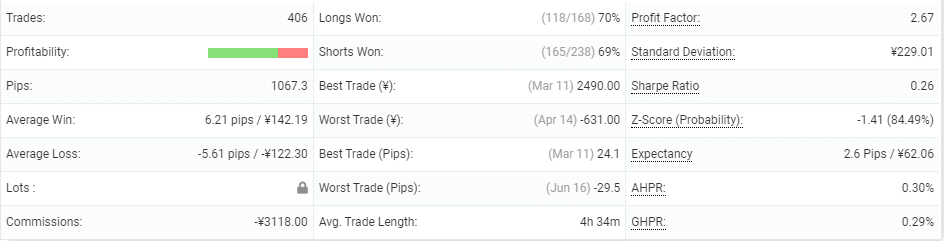

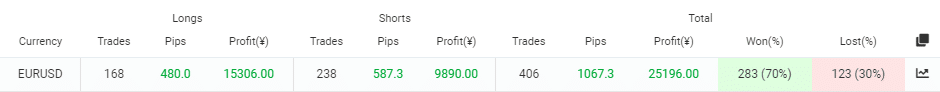

It has closed 406 orders with 1067 pips. An average win is 6.21 pips when an average loss is -5.61 pips. The win rate is 70% for longs and 69% for shorts. An average trade length is 4 hours 34 minutes. The profit factor is 2.67.

The advisor trades only one pair. The Shorts direction is traded more frequently, 238 orders when shorts is more profitable ¥15,306.

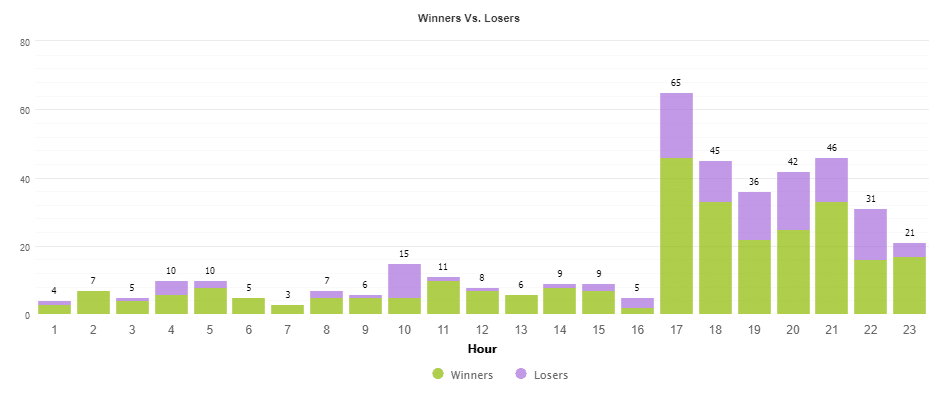

The most-traded hours are within the American trading session.

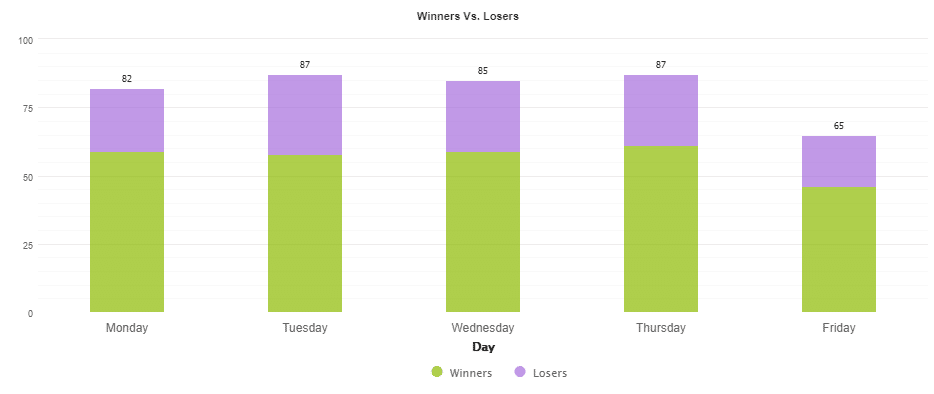

Friday is a less traded day, among others.

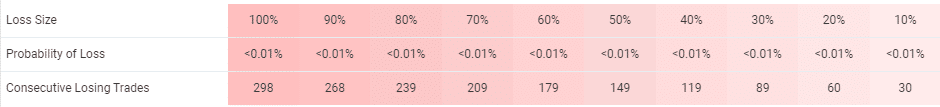

The system works with low risks.

The expert advisor uses a medium-sized a Grid of six orders. We cannot be sure there’s no martingale because lot size data is hidden.

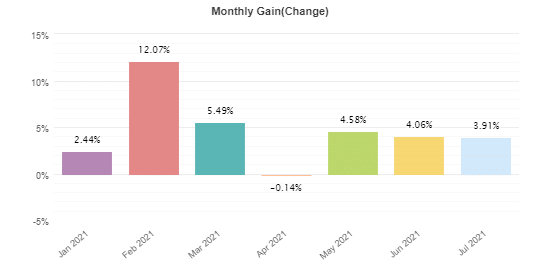

Monthly profitability varies much depending on the months and market conditions.

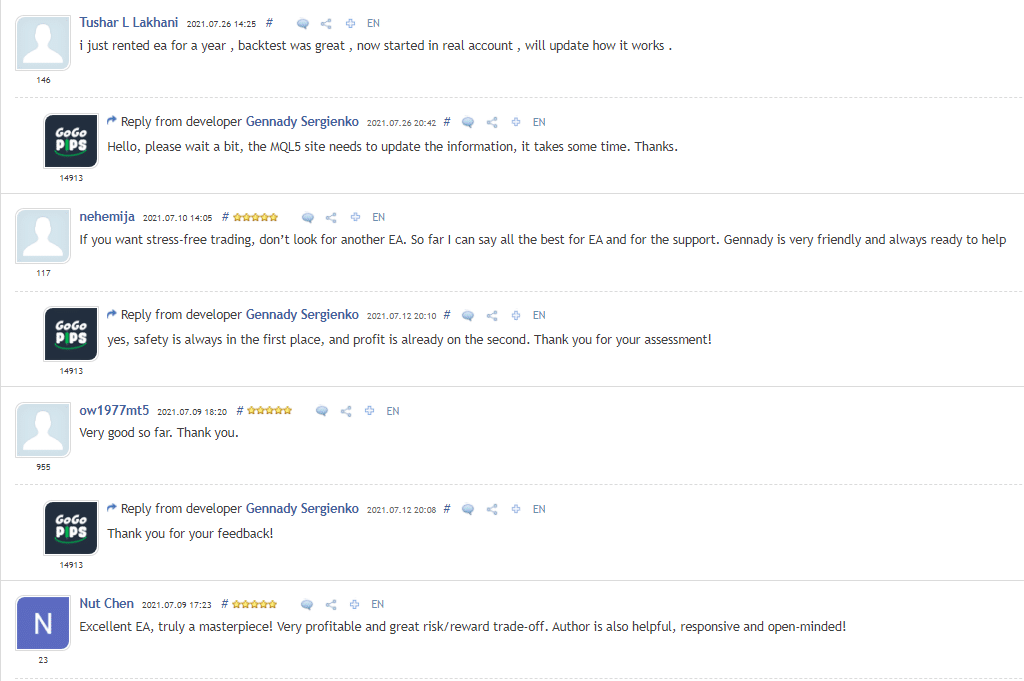

What are the real customers saying about Stenvall Mark III?

All comments are positive. We keep checking them for updates.

Other notes

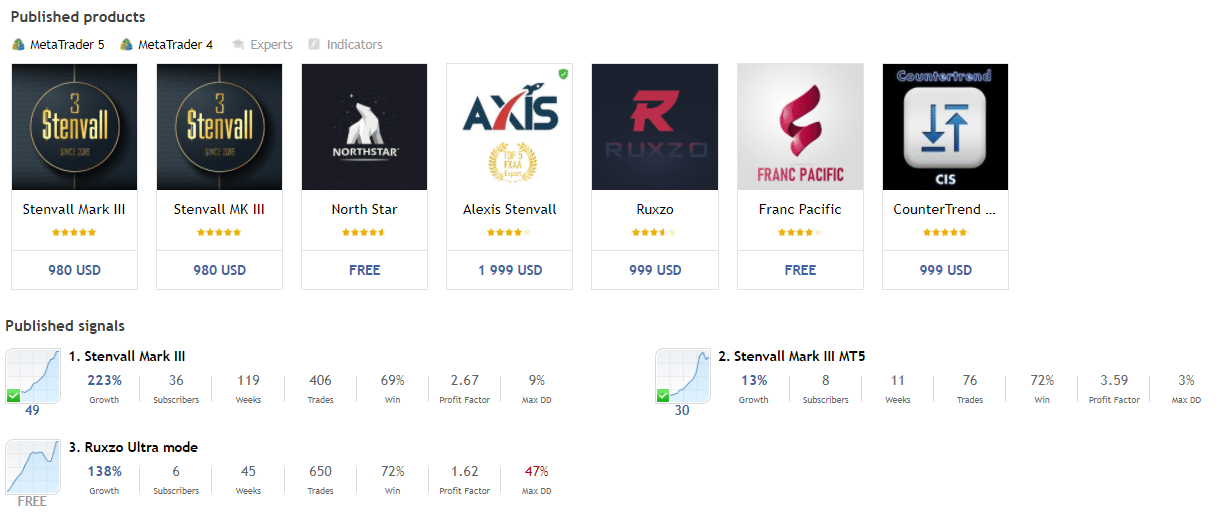

There are seven products in the dev’s portfolio: North Star, Alexis Stenvall, Ruxzo, Franc Pacific, Counter Trend Indicator, and Stenvall Mark III.

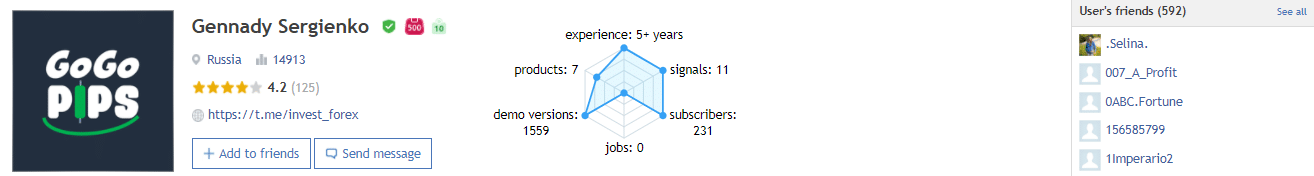

Gennady Sergienko is a developer from Russia who has a 14,914 rate and 592 friends. His products have a 4.2 rate based on 125 reviews. There are 231 subscribers for his signals.

Summary: is Stenvall Mark III a trustworthy EA?

Stenvall Mark III-

Strategy3/5 Neutral

-

Features3/5 Neutral

-

Trading Results3/5 Neutral

-

Reliability3/5 Neutral

-

Pricing2/5 Bad

Like

- Backtest reports provided

- Strategy explanations provided

- Trading results shown

Dislike

- No risk advice given

- No settings explanations provided

- A grid of orders strategy

- Lack of testimonials

- The account is low deposited